In today’s gig economy, it’s increasingly critical to understand the differences between independent contractors and employees in terms of their work relationships, tax implications, and legal rights.…

The statement of retained earnings is a financial report that outlines the changes in a company’s retained earnings over a specified period. Retained earnings represent the accumulated…

An owner’s draw is a financial mechanism through which business owners can withdraw funds from their company for personal use. This method of payment is common across…

Net income is a crucial financial metric for individuals and businesses, as it provides insight into the amount of money remaining after key deductions, such as taxes…

Net income is a critical financial metric that helps determine a company’s profitability. It is calculated by subtracting all expenses, including operating costs, taxes, and interest, from…

Nonprofit accounting is a unique process that allows nonprofit organizations to plan, record, and report on their finances. It differs from for-profit accounting in several ways, including…

Operating expenses, commonly known as OpEx, are the costs that a business incurs through its normal operations. These expenses are essential for analyzing a company’s operational performance…

Outsourced accounting refers to the practice of employing an external provider to manage a company’s financial tasks and responsibilities, such as bookkeeping, tax management, and financial reporting.…

Overhead is an essential aspect of running a business, with costs that are indirectly related to producing a product or service. These costs are generally not attributable…

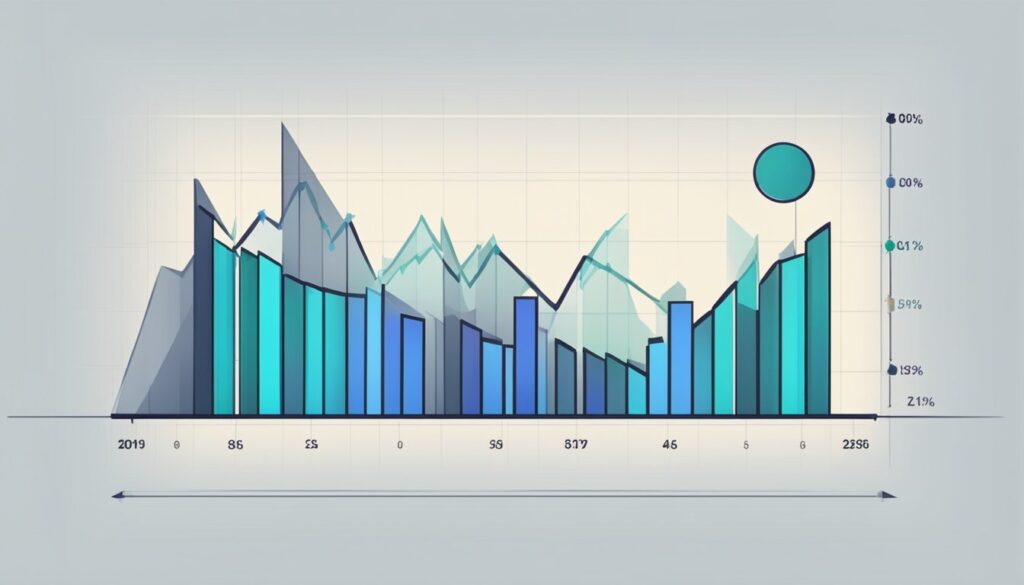

Straight line depreciation is a method used to allocate the cost of a capital asset over its useful life. It is the simplest and most commonly employed…

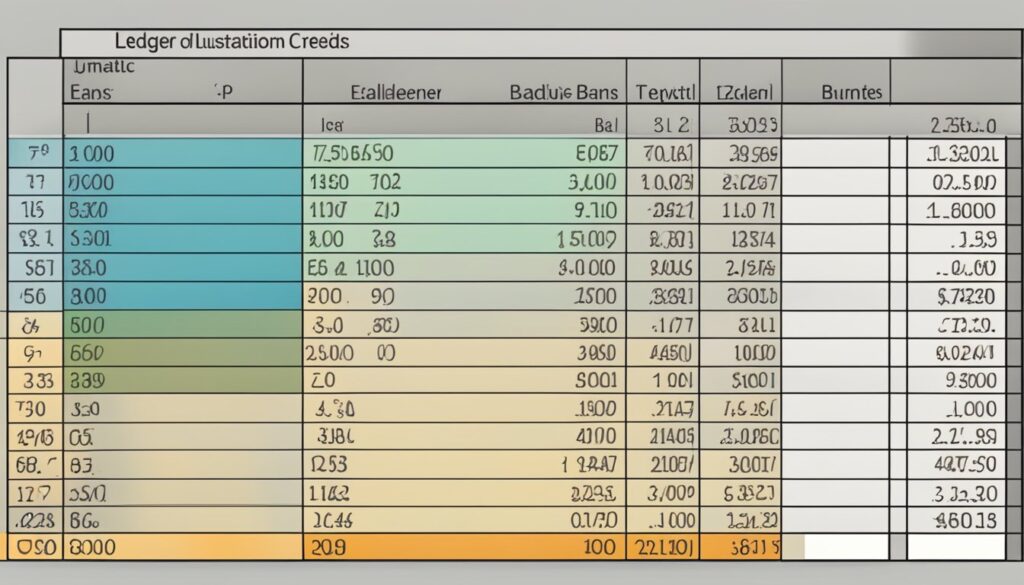

A trial balance is a crucial component of the accounting process, as it serves as a bookkeeping worksheet that guarantees a company’s financial records are mathematically accurate.…

Unearned revenue is a financial term that represents payments received by a company for goods or services that have not yet been provided or delivered. This occurs…