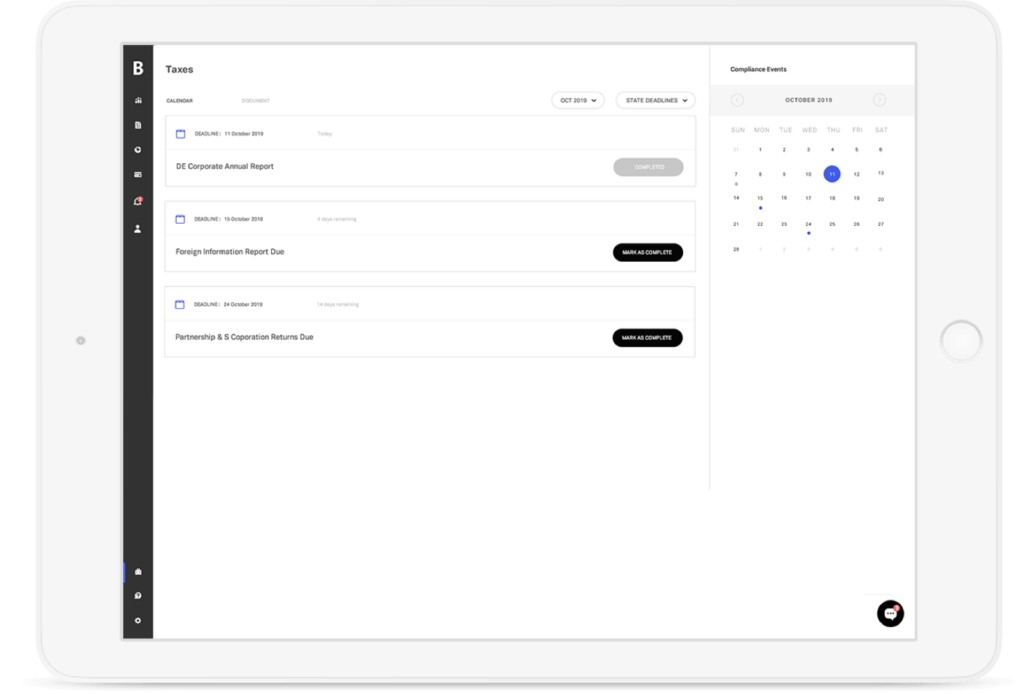

Let the team at Finally handle your corporate and business taxes stress free. At Finally, we take the pain and misery out of filing your taxes. No more confusion as to what you need to do when, thanks to our tax compliance calendar.

We simplify the process to make sure that you fully understand how your business is taxed and when it is taxed ahead of time; we don’t believe in surprises when it comes to taxes.

Your Finally tax team allows you to see your tax liability in real-time. No more surprises when it comes to tax time. Tax time will no longer be stressful because you’ll always be able to check your tax liability on a quarterly basis. Knowing ahead of time makes sure that you are mindful of any cash flow implications.

We understand that you need a new equipment or vehicles for your business. Is it sensible to buy that truck now or should I lease it? This is a question that can be answered by Finally Tax. We calculate your tax implications for each asset on a quarterly basis to provide you with definitive answers to your asset acquisition inquiries. Our tax specialists are always available to speak to you when you are mulling over purchasing a new piece of equipment.

Finally is always here as a sounding board to provide solid guidance in all equipment purchases your business is considering.

It is very important for a business to understand how expenses affect the bottom line. Knowing how your bottom line is affected, you should be able to obtain a better understanding about the financial health of your business.

For some businesses, nearly 1/3 of their annual revenue is spent on travel alone. Expenditure reports allow you to put the brakes on, or at the very least, keep employee expenses within reasonable amounts.

It is very important for a business to understand how expenses affect the bottom line. Knowing how your bottom line is affected, you should be able to obtain a better understanding about the financial health of your business.

For some businesses, nearly 1/3 of their annual revenue is spent on travel alone. Expenditure reports allow you to put the brakes on, or at the very least, keep employee expenses within reasonable amounts.

It is very important for a business to understand how expenses affect the bottom line. Knowing how your bottom line is affected, you should be able to obtain a better understanding about the financial health of your business.

For some businesses, nearly 1/3 of their annual revenue is spent on travel alone. Expenditure reports allow you to put the brakes on, or at the very least, keep employee expenses within reasonable amounts.

It is very important for a business to understand how expenses affect the bottom line. Knowing how your bottom line is affected, you should be able to obtain a better understanding about the financial health of your business.

For some businesses, nearly 1/3 of their annual revenue is spent on travel alone. Expenditure reports allow you to put the brakes on, or at the very least, keep employee expenses within reasonable amounts.