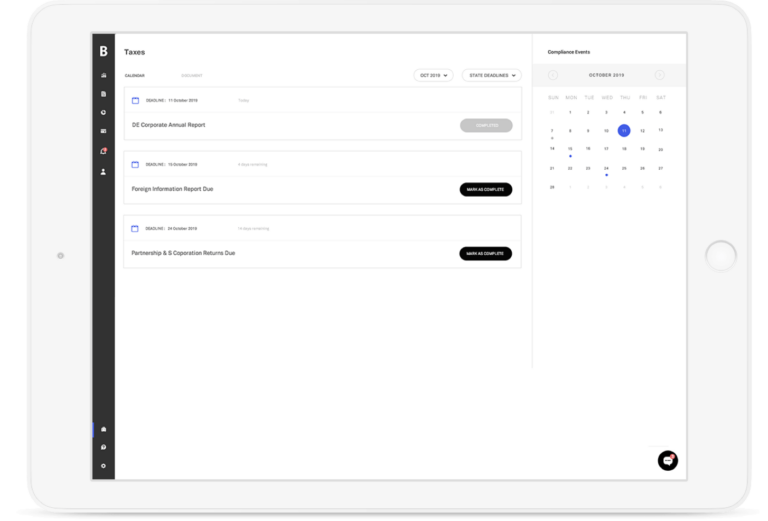

We all know that the IRS & State tax authorities don’t play around when it comes to deadlines or rules regarding tax compliance requirements. Penalties and, interests are a real threat that every business owner faces if found to be noncompliant.

Each different business setup, size, and type may require different tax compliance requirements. Our team understand the importance of meeting the tax deadlines. The Back Office tax compliance team will send you automatic alerts to remind you of deadlines to help you steer clear of the penalties and interest. Never again worry that you missed a filing deadline.

Once your business is approved, you get access to a Corporate card our innovative suite of financial software programs.

It is very important for a business to understand how expenses affect the bottom line. Knowing how your bottom line is affected, you should be able to obtain a better understanding about the financial health of your business.

For some businesses, nearly 1/3 of their annual revenue is spent on travel alone. Expenditure reports allow you to put the brakes on, or at the very least, keep employee expenses within reasonable amounts.

It is very important for a business to understand how expenses affect the bottom line. Knowing how your bottom line is affected, you should be able to obtain a better understanding about the financial health of your business.

For some businesses, nearly 1/3 of their annual revenue is spent on travel alone. Expenditure reports allow you to put the brakes on, or at the very least, keep employee expenses within reasonable amounts.

It is very important for a business to understand how expenses affect the bottom line. Knowing how your bottom line is affected, you should be able to obtain a better understanding about the financial health of your business.

For some businesses, nearly 1/3 of their annual revenue is spent on travel alone. Expenditure reports allow you to put the brakes on, or at the very least, keep employee expenses within reasonable amounts.

It is very important for a business to understand how expenses affect the bottom line. Knowing how your bottom line is affected, you should be able to obtain a better understanding about the financial health of your business.

For some businesses, nearly 1/3 of their annual revenue is spent on travel alone. Expenditure reports allow you to put the brakes on, or at the very least, keep employee expenses within reasonable amounts.