Tax relief companies play a crucial role in assisting individuals and businesses who are struggling with tax debt. These companies employ a team of experts, such as…

As the COVID-19 pandemic continues to impact the economy, many individuals are concerned about the tax implications of their stimulus checks. The federal government has issued multiple…

SUTA tax, or State Unemployment Tax Act, is a payroll tax that employers are required to pay to fund state unemployment benefits for workers who have lost…

The T2125 form, also known as the Statement of Business or Professional Activities, is a crucial tax form for self-employed individuals and partnerships in Canada. This form…

T4, or thyroxine, is a critical thyroid hormone responsible for regulating metabolism in the body. The thyroid gland, a small butterfly-shaped organ in the neck, produces T4.…

The T5013 form is an essential document for partnerships operating in Canada. This form is used to report a partnership’s financial information to the Canada Revenue Agency…

Tax advisors play a critical role in helping individuals and businesses navigate the complex world of taxation. These professionals possess expertise in tax planning, preparation, and compliance.…

Navigating the complex world of taxes can be a daunting task for many individuals and businesses. With the ever-changing tax laws and regulations, getting the professional help…

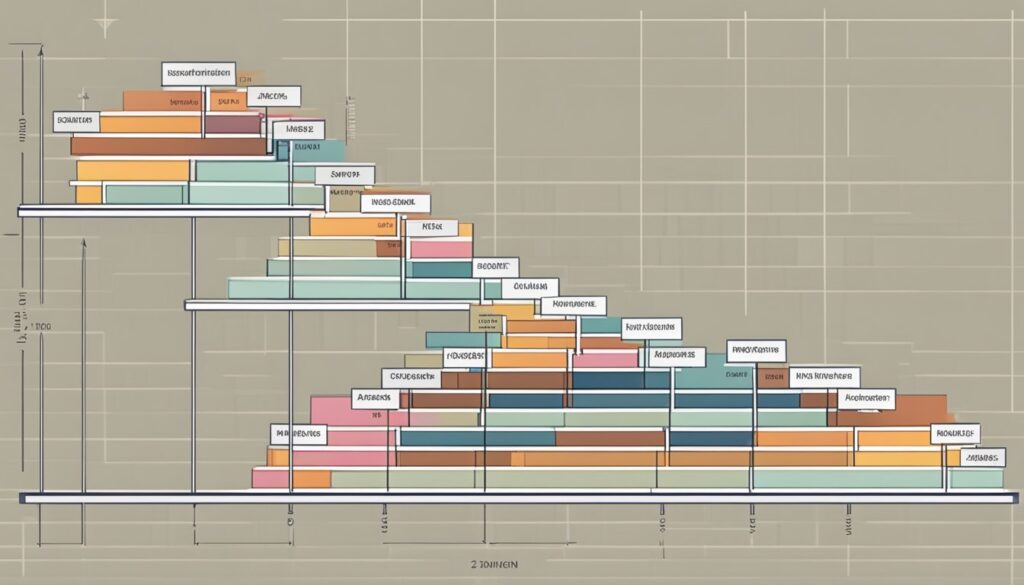

Tax brackets are an essential component of the federal income tax system in the United States. They help determine the percentage of an individual’s taxable income that…

Tax deadlines are crucial dates that taxpayers should be aware of in order to avoid penalties and ensure timely filing of their tax returns. The Internal Revenue…

Taxes can be a complex topic for many individuals, but understanding the differences between tax credits and tax deductions is crucial for reducing one’s tax liability. Both…

Starting a business involves various expenses, some of which can be daunting for new entrepreneurs. However, the Internal Revenue Service (IRS) acknowledges these costs and offers startups…