Navigating the world of self-employed taxes in Canada can be complex but understanding the basics is essential to staying compliant and maximizing deductions. Self-employed individuals, such as…

Schedule SE is a crucial form for those who are self-employed, as it is used to calculate and report self-employment taxes, which include contributions to Social Security…

Schedule C is an essential tax form for many individuals who derive income from business or professional activities as a sole proprietor or single-member LLC. This form…

Schedule A is a crucial form used by U.S. taxpayers who choose to itemize their tax-deductible expenses rather than taking the standard deduction. It is filed alongside…

The Section 179 deduction is a provision in the United States tax code that allows business owners to immediately expense the cost of certain qualifying business assets,…

The Corporate Transparency Act (CTA), enacted in 2021, is a significant piece of legislation aimed at combating illicit activities such as money laundering, tax fraud, and terrorism…

Filing taxes can often be a daunting task, but knowing when you can file is essential to ensure you don’t miss deadlines. The annual tax-filing season generally…

Work-related education classes and workshops offer a practical way for professionals to stay current in their fields and develop new skills. These educational programs help individuals enhance…

Wyoming, also known as the Equality State or Cowboy State, is a treasure trove of natural beauty and rich history that captivates visitors and locals alike. As…

Franchise tax is a state-imposed tax on certain businesses for the privilege of existing as a legal entity and conducting business within a specific jurisdiction. It is…

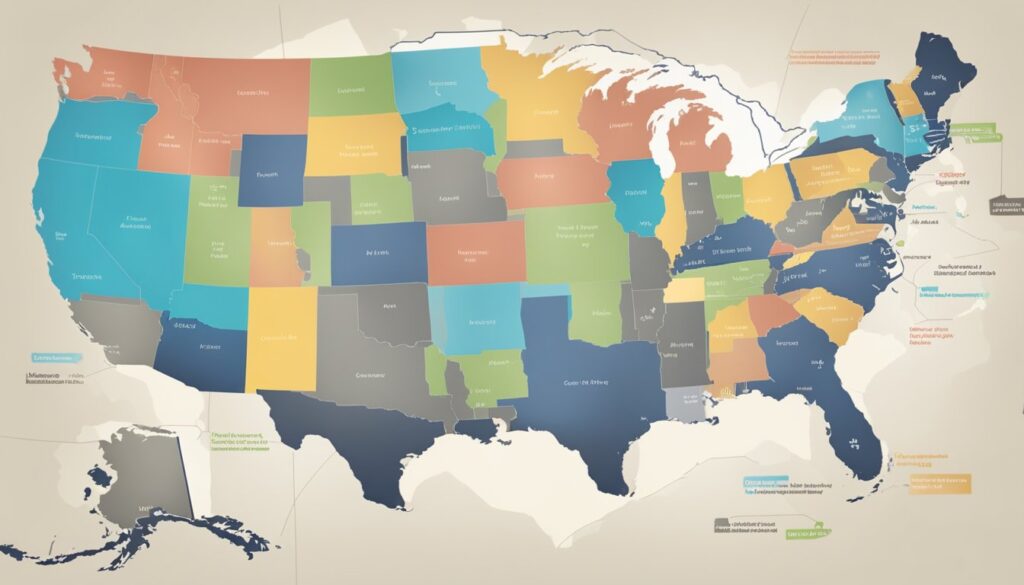

Sales tax nexus refers to the specific connections or links that a business establishes with a particular jurisdiction, requiring it to register and collect sales tax in…

Sales tax is a consumption tax that applies to retail sales made to end consumers. As a business owner, it’s crucial to have a fundamental understanding of…