The break-even point (BEP) is a critical concept in finance and business, as it represents the level at which a company’s total costs equal its total revenues. At the break-even point, a company neither makes a profit nor incurs a loss. Understanding the break-even point is crucial for businesses, as it helps in determining pricing strategies, evaluating profitability, and making informed decisions on production levels.

To calculate the break-even point, it’s essential to understand both fixed and variable costs involved in the production. Fixed costs are the expenses that remain constant regardless of the number of goods produced, while variable costs change based on production volume. By dividing fixed costs by the price per unit minus the variable cost per unit, a business can determine its break-even point. This information not only plays a vital role in accounting and financial planning but also guides the company in making strategic decisions.

Key Takeaways

- The break-even point is when a company’s total costs equal its total revenues.

- Understanding fixed and variable costs is crucial for calculating the break-even point.

- Knowing the break-even point assists in pricing strategies, profitability evaluations, and production decisions.

Understanding the Break-Even Point

Definition and Significance

The break-even point is a critical financial concept that plays a significant role in business decision-making. It represents the point where a company’s total revenue equals its total costs, resulting in neither profit nor loss. Reaching the break-even point is essential for businesses, as it helps in determining the minimum sales volume needed to cover all expenses. Moreover, break-even analysis contributes to strategic decisions on pricing, production, and resource allocation.

There are two key types of costs that are relevant to the break-even analysis:

- Fixed costs: These costs remain constant regardless of the production volume. Examples include rent, insurance, and salaries.

- Variable costs: These costs fluctuate based on the number of units produced. Examples include raw materials, utilities, and labor associated directly with the production process.

Break-Even Point Formula

To calculate the break-even point, one must be familiar with the fixed costs, variable costs, and total sales revenue. The break-even point formula can be expressed as:

Break-Even Point (units) = Fixed Costs / (Revenue per Unit – Variable Costs per Unit)

This formula can be applied to measure the break-even point both in terms of units and dollars of revenue. The resulting break-even point helps a company:

- Understand the minimum sales needed to cover costs.

- Identify potential scenarios for profit and loss based on different sales volumes.

- Make informed decisions on pricing, production, resource allocation, and expansion.

To calculate the break-even point, follow these steps:

- Determine the fixed costs.

- Determine the variable costs per unit.

- Determine the revenue per unit.

- Plug the values into the break-even point formula.

By understanding and applying the break-even point concept, businesses can make more strategic decisions and aim for growth, profitability, and long-term success.

Calculating Fixed and Variable Costs

Identifying Fixed Costs

Fixed costs are expenses that do not change with the level of production or sales. They are incurred by a business regardless of its operations. Some common examples of fixed costs include:

- Rent: This is the cost of occupying a physical space, such as an office or a store. It’s usually paid in monthly or annual installments and does not change based on the number of goods produced or sold.

- Salaries: These are the payments made to employees for their work. Salaries are typically fixed because they are agreed upon in advance and usually do not change based on the number of units produced.

- Insurance: Businesses often acquire different types of insurance policies to protect themselves from various risks. Insurance premiums are generally fixed and have to be paid periodically regardless of the business’s performance.

- Depreciation: Depreciation is the reduction in the value of assets, such as equipment or machinery, over time. It is considered a fixed cost because it occurs even if the business is not producing any goods.

Identifying Variable Costs

Variable costs, on the other hand, change with the level of production or sales. They increase as more goods are produced and decrease as production declines. Some common examples of variable costs include:

- Materials: The raw materials or components required to produce goods are considered variable costs. They change depending on the number of units produced.

- Labor: While salaries are fixed costs, wages paid to workers based on their hours worked or production output can be a variable cost. An increase in production often leads to an increase in labor hours and wages.

- Utilities: Some utility costs, such as electricity and water, can be variable costs. Their usage may depend on the level of production, resulting in fluctuating costs.

- Variable Costs Per Unit: This refers to the cost incurred per unit produced. It can include costs such as raw materials, labor, and packaging.

In summary, when calculating the break-even point for a business, it’s essential to accurately identify and categorize fixed and variable costs. By doing so, businesses can determine the necessary sales volume or revenue to cover all costs and begin generating a profit.

Revenue and Pricing Strategies

Setting the Right Selling Price

When determining the optimal selling price for your product, it is crucial to consider both your total costs (fixed and variable) and the desired profit margin. One key factor in this decision is the break-even point, which is the point at which your total revenue equals your total costs. Understanding the break-even point will help ensure that you set a competitive price for your product while covering costs and generating profit.

Your break-even point is calculated using the following formula:

Break-even point = Fixed Cost / (Average Selling Price per Unit - Variable Cost per Unit)

Here’s a brief explanation of the terms in the formula:

- Fixed Cost: These are costs that remain constant regardless of the number of units produced, such as rent, utilities, and salaries.

- Average Selling Price per Unit: The average price at which a single unit of your product is sold in the market.

- Variable Cost per Unit: These are costs that vary according to the number of units produced, such as raw materials and labor directly related to the production process.

It is essential to conduct regular market research and customer profiling to ensure that your selling price remains attractive, competitive, and relevant.

Understanding Market Price

Market price refers to the prevailing price at which a product is sold in the marketplace. It is determined by the forces of supply and demand – when demand is higher than supply, prices tend to rise. Conversely, when supply is higher than demand, prices tend to fall.

To set a competitive selling price, you must analyze and understand the market price of similar products or services. You can gather this information by researching competitor prices, customer preferences, and industry trends. By setting your price in line with or slightly below the market price, you’ll be better positioned to attract customers and generate sales.

In summary, the break-even point plays a significant role in determining the right selling price for your product. By considering your total costs and market price, you will set a competitive price that covers costs, generates profit, and attracts customers. Regular market research and knowledge of industry trends are essential to maintaining a successful and sustainable pricing strategy.

Contribution Margin Analysis

Concept of Contribution Margin

The contribution margin is a crucial concept in break-even analysis, as it helps businesses understand their profitability on each product or service sold. In essence, the contribution margin is the difference between a product’s selling price and its variable costs. This margin represents the amount of revenue generated by a product that contributes to covering fixed costs and ultimately leads to profits.

By analyzing the contribution margin, businesses can make informed decisions about product pricing, cost reduction, and resource allocation. A higher contribution margin indicates that more revenue is available for covering fixed costs and generating profit, while a lower margin suggests a need for improvement in pricing strategy or cost management.

Contribution Margin Per Unit

To calculate the contribution margin per unit, it is necessary to subtract the variable cost per unit from the selling price per unit. The resulting value indicates how much profit each unit brings in after covering the variable expenses tied to its production or sales. For example:

| Product | Selling Price | Variable Cost | Contribution Margin Per Unit |

|---|---|---|---|

| Product A | $100 | $60 | $40 |

| Product B | $150 | $90 | $60 |

In this table, Product A has a selling price of $100 and a variable cost of $60, resulting in a contribution margin per unit of $40. Product B’s selling price is $150, with a variable cost of $90, yielding a contribution margin per unit of $60. These figures help businesses understand which products are more profitable and should be prioritized.

By analyzing the contribution margin per unit, managers can make better-informed decisions about product pricing and cost management. This information can also be useful in evaluating the overall performance of a product in comparison to its competitors and within the industry as a whole. Ultimately, a solid understanding of contribution margin analysis is essential for businesses to achieve optimal profitability and growth.

Applying Break-Even Analysis to Business Decisions

Decision-Making Based on Break-Even Analysis

Break-even analysis is a powerful tool used by businesses to make informed decisions about projects and investments. By comparing revenues and expenses, this analysis helps businesses determine the number of units or dollars of revenue needed to cover their total costs, including both fixed and variable costs. The point at which total costs and total revenue are equal is known as the break-even point.

Understanding the break-even point is crucial for business owners, as it allows them to evaluate the viability of a project or investment. For example, if the break-even point for a new product is unreasonably high, it may indicate that the product is not a wise investment. On the other hand, if the break-even point is easily attainable, the project may be more feasible.

In order to conduct a break-even analysis, the following components are essential:

- Fixed costs: These are the unchanging expenses that a business must pay regardless of its level of production, such as rent or salaries.

- Variable costs: These expenses vary depending on the level of production, such as raw materials and labor costs.

- Contribution margin: This is the difference between the selling price of a product and its variable costs, which is used to cover fixed costs and generate profit.

Impact of Business Decisions on Break-Even Point

Since the break-even point directly impacts the success of a project, it is essential to understand how various business decisions may influence it. Key factors that can affect the break-even point include:

- Pricing: Changing the selling price of a product will impact the contribution margin, which in turn, will alter the break-even point. If the price is increased, the break-even point will decrease, making it easier to attain profitability. Conversely, if the price is reduced, the break-even point will increase, making it challenging to reach.

- Production costs: Any change in fixed or variable costs will directly impact the break-even point. For instance, investing in more efficient machinery may reduce variable costs, which would lower the break-even point and make it easier to reach profitability. On the other hand, an increase in rent or raw material prices may raise the break-even point, creating a higher sales target for profitability.

- Marketing and promotions: Effective marketing and promotional efforts can lead to higher sales volumes, making it easier to reach the break-even point. However, the cost of these campaigns must also be considered, as they may increase the overall expenses, affecting the break-even point.

- Market demand: If the demand for a product is high, it will be easier to sell a higher volume of units, contributing to a lower break-even point. Businesses should keep an eye on market trends and consumer preferences to ensure they are meeting demand and maintaining a favorable break-even point.

In conclusion, break-even analysis is an essential tool for decision-making in any business. Through careful evaluation of various factors such as pricing, production costs, marketing, and market demand, business owners can assess the feasibility of a project, investment, or product and make informed decisions that maximize profitability and minimize risk.

Role of Accounting in Break-Even Analysis

Cost Accounting Techniques

In break-even analysis, accounting plays a significant role in helping businesses determine the right balance between their costs and revenues. One of the key aspects of accounting that contributes to break-even analysis is cost accounting. Cost accounting focuses on collecting, analyzing, and allocating costs to different products, services, or operational activities. Through cost accounting techniques such as activity-based costing, businesses can identify their fixed and variable costs accurately.

Fixed costs are expenses that remain constant regardless of production levels, while variable costs change based on the volume of goods or services produced. Examples of fixed costs include rent, salaries, and depreciation. Variable costs, on the other hand, may include direct materials, labor, and utilities.

Using cost accounting methods, businesses can calculate the break-even point by finding the number of units required to be sold to cover all fixed and variable costs. The break-even point is calculated using the formula:

Break-even point (in units) = Fixed Costs / (Selling Price per Unit - Variable Cost per Unit)

Financial Statements and Break-Even

Another essential aspect of accounting relevant to break-even analysis is the use and interpretation of financial statements. Financial statements, such as the income statement and balance sheet, provide valuable insights into a company’s revenues, costs, and overall financial health, enabling businesses and accountants to determine the break-even point.

The income statement documents a company’s revenues and expenses, with the difference between these two figures reflecting its profits or losses. By analyzing the income statement, businesses can identify trends in sales and expenses and assess whether their current levels of production are sufficient to cover their costs. When the income statement shows that the revenue equals the expenses, that moment represents the break-even point.

In summary, accurate accounting for costs and the effective use of financial statements play crucial roles in break-even analysis. By employing cost accounting techniques and interpreting financial statements, businesses can calculate their break-even points, enabling them to make informed operating decisions and ultimately achieve their financial goals.

Advanced Break-Even Analysis Techniques

Cost-Volume-Profit Analysis

Cost-Volume-Profit (CVP) analysis is a powerful tool frequently used by managerial accountants to analyze the relationship between cost, volume, and profit at various production levels. It helps businesses understand the importance of the break-even point and its impact on the organization.

The break-even quantity is a critical measure derived from CVP analysis, which refers to the number of units a business needs to produce and sell to cover all its fixed and variable costs. To calculate the break-even quantity, the formula is:

Break-even quantity = Fixed costs / (Selling price per unit – Variable cost per unit)

CVP analysis allows businesses to determine the impact of changing cost structures, selling prices, and production levels on their overall profitability.

Sensitivity Analysis in Break-Even

Sensitivity analysis is an essential technique in financial analysis and financial modeling and can be applied to break-even analysis to uncover the impact of changes in cost structures and sales variables on a company’s break-even point.

By altering individual factors such as fixed costs, variable costs, and selling prices, sensitivity analysis identifies how sensitive the break-even point is to changes in these parameters. This analysis helps businesses make informed decisions about adjusting prices, entering new markets, or investing in new technologies.

Some key steps to perform sensitivity analysis in break-even situations are:

- Identify the key factors affecting the break-even point (i.e., fixed costs, variable costs, and selling prices).

- Determine a range of possible values for each factor.

- Recalculate the break-even quantity for each scenario.

- Assess the impact of changes in each factor on the break-even point.

In summary, advanced break-even analysis techniques like cost-volume-profit analysis and sensitivity analysis can provide companies with a deeper understanding of their financial health, enabling more informed decision-making. These techniques help businesses identify potential changes in their operations that may improve profitability and reduce risk.

Leveraging Technology for Break-Even Calculations

In today’s digital age, businesses can significantly benefit from leveraging technology to perform break-even calculations more efficiently and with a higher degree of accuracy. This section will explore the use of spreadsheet software and dedicated break-even calculation tools to analyze and determine an organization’s break-even point.

Spreadsheet Solutions

Excel is a popular spreadsheet software that allows users to create sophisticated financial models and perform various calculations, including break-even analysis. One powerful feature of Excel is its Goal Seek functionality. Goal Seek allows users to find the required input value to achieve a specific goal, such as calculating how many units need to be sold to reach the break-even point.

To perform a break-even analysis in Excel, the following components should be entered into the spreadsheet:

- Fixed costs: The costs that remain constant regardless of the number of units produced.

- Variable costs per unit: The costs that change based on the number of units produced.

- Selling price per unit: The revenue generated by selling one unit of the product.

By utilizing Excel formulas, the user can then calculate the break-even point as:

Break-Even Point (Units) = Fixed Costs / (Selling Price per Unit – Variable Costs per Unit)

Excel provides the ability to see the impact of various variables on the break-even point through the use of charts and graphs. This visual representation can significantly assist businesses in making informed decisions to achieve their financial objectives.

Break-Even Calculation Tools

In addition to spreadsheet software, there are dedicated break-even calculation tools specifically designed to simplify the process of determining the break-even point. These tools often present an easy-to-use interface that prompts users to enter the required information, such as fixed costs, variable costs, and selling price, and then instantly calculates the break-even point.

These calculators typically offer additional insights and visualizations, such as sensitivity analysis, to help businesses understand how changes in different variables may affect their break-even point. Some of these tools are available as downloadable software, while others can be accessed through web browsers.

In conclusion, leveraging technology, such as Excel and break-even calculation tools, can greatly streamline the process of calculating the break-even point and allow businesses to make well-informed financial decisions.

Frequently Asked Questions

How do you determine the break-even point using the formula?

To determine the break-even point using the formula, follow these steps:

- Calculate the fixed costs, which are the expenses that remain unchanged regardless of the level of production or the number of sold units.

- Calculate the variable costs per unit produced, which are the expenses that change as the production volume changes.

- Identify the selling price per unit, which is the price at which the product is sold.

The break-even point formula is given by:

Break-even point (units) = Fixed costs / (Selling price per unit – Variable costs per unit)

How can you find the break-even point with a calculator efficiently?

To find the break-even point using a calculator efficiently, have all necessary inputs (fixed costs, variable costs per unit, and selling price per unit) at hand. Then, follow these steps:

- Subtract the variable costs per unit from the selling price per unit.

- Divide the fixed costs by the result obtained in step 1.

The result will be the break-even point (units). You can then multiply this number by the selling price per unit to find the break-even point in terms of revenue.

Can you provide an example to illustrate how to calculate break-even point?

For example, assume a business has fixed costs of $10,000, variable costs per unit of $20, and a selling price per unit of $50. Calculate the break-even point as follows:

- Subtract the variable costs per unit ($20) from the selling price per unit ($50), which equals to $30.

- Divide the fixed costs ($10,000) by the result obtained in step 1 ($30).

The break-even point is 333.33 units, which means the business needs to sell approximately 334 units to cover both fixed and variable costs and not incur a loss.

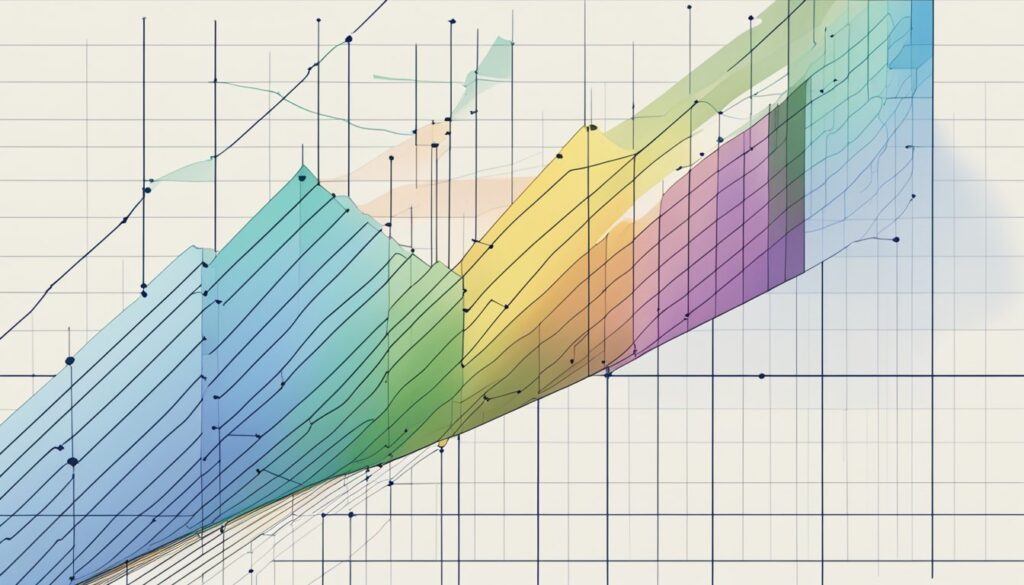

What does a break-even point graph typically look like, and how is it interpreted?

A break-even point graph has the number of units on the X-axis (horizontal) and the dollar amount on the Y-axis (vertical). There are two main lines on this graph:

- The red line represents the total fixed costs, which remains constant at all levels of production.

- The blue line represents the total revenue, which increases as the number of units sold increases.

The break-even point is where the red (fixed costs) and blue (total revenue) lines intersect. At this point, the business neither makes a profit nor incurs a loss, as total revenue equals total costs.

What distinguishes break-even point in accounting from its use in general business?

In accounting, the break-even point refers to the level of sales required to cover all operating expenses, without considering financing costs and taxes. It is mainly used by accountants to analyze a company’s financial performance and profitability.

In general business, break-even point is a broader concept, encompassing different elements such as sales and marketing, pricing strategies, and market competition. Business managers utilize the break-even analysis to make informed decisions regarding product pricing, required sales volumes, and cost reduction initiatives.

What is the significance of the break-even point in financial analysis?

The break-even point is significant in financial analysis because it:

- Helps businesses determine the level of sales required to cover all costs and start generating profit.

- Assists in pricing strategies by understanding how different price points impact profit margins.

- Aids in decision-making concerning cost-cutting measures or increasing production efficiency.

- Allows investors to evaluate a company’s performance and assess its ability to meet required sales levels and generate profit.

By knowing the break-even point, business owners and investors can set realistic goals and minimize financial risks.